Tomorrow is a Big Day for Bitcoin: What Are FED Expectations?

Crypto traders are waiting for the September 21st FOMC. Amid this anticipation, there is an increase in volatility in Bitcoin and altcoin prices. Traders are reducing their risk and preparing for a tightening in monetary policy. As a result, the Bitcoin price has fallen 15% in the last seven days.

"Bitcoin price decline will continue with interest rate hikes"

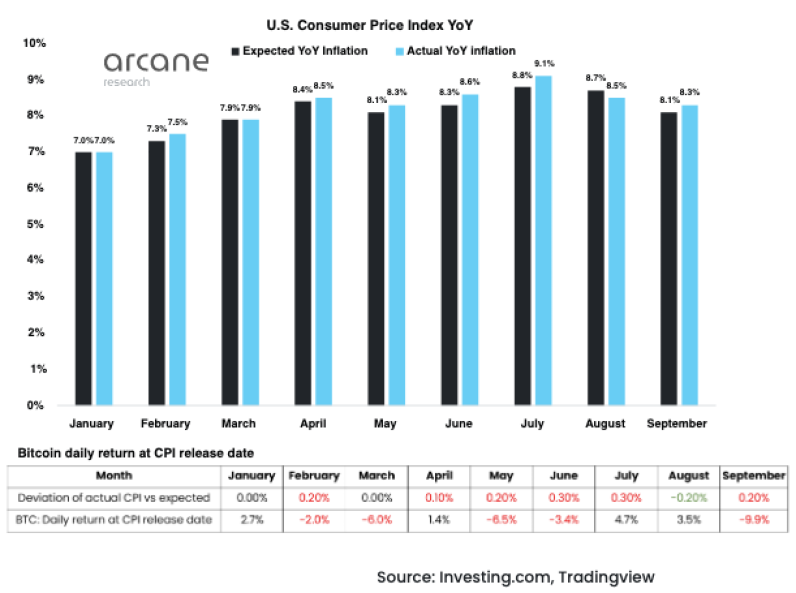

The price of the leading crypto Bitcoin (BTC) fell last week along with a drop in stocks. As you have been following on cryptoify.blogspot.com, the August US CPI came in at 8.3% compared to expectations of 8.1%. Markets perceived the higher-than-expected CPI as a sign of the Fed's continued hawkish stance. The market reacted to the CPI news with risk aversion. In this environment, Bitcoin also witnessed a major decline.

|

| US Consumer Price Index YY |

The drop in the price of Bitcoin last week was the worst compared to previous CPI-related declines in the asset in 2022. The brutal reaction was a result of expectation mismatch and uncertainty among investors ahead of this week's FOMC. Analysts at Arcane Research note that the crypto market is pricing in a high interest rate hike.

|

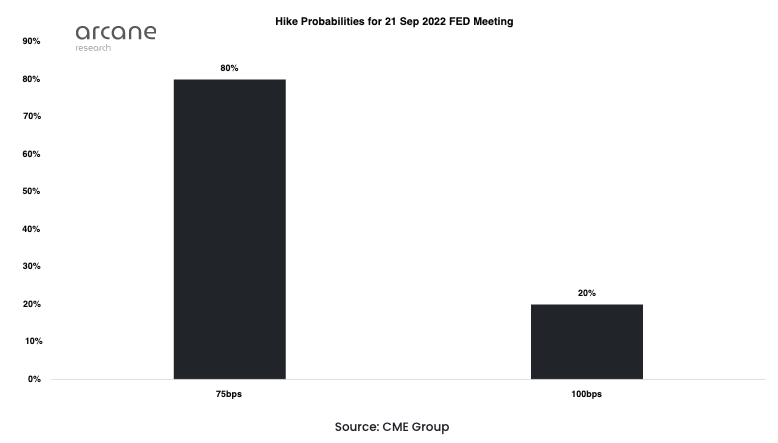

| Hike probabilities for the September 21, 2022 FED meeting |

The current expectation is for 75 bps. The markets give it an 80% probability. However, investors are not ruling out a possible 100 bps increase. Therefore, this week's decision will be key to Bitcoin's price trend. Because all the FOMC events have led to volatility in the Bitcoin price. Analysts warn traders to prepare for a new explosion in BTC volatility on September 21.

|

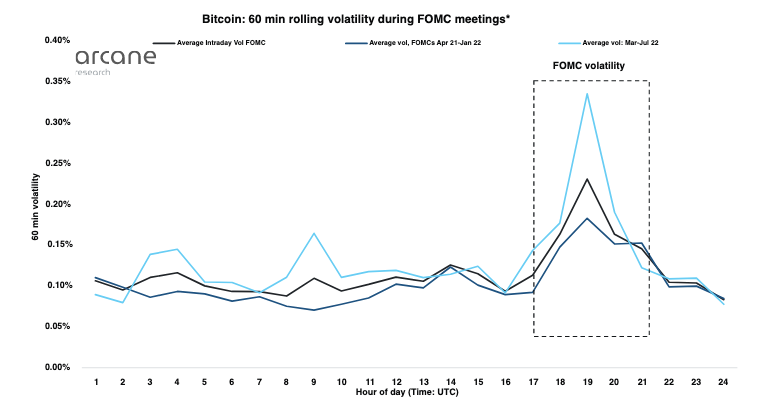

| Bitcoin volatility during FOMC meetings |

Bitcoin price tends to move in a highly correlated manner with the Nasdaq and S&P 500 during major macro events such as FOMC meetings.

Trading strategy for BTC during the FOMC statement

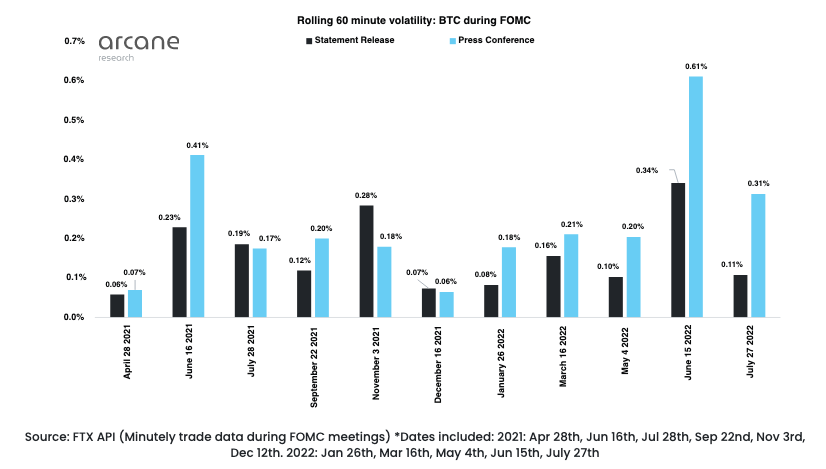

To help traders make trades during the FOMC meeting, the researchers prepared a 60-minute volatility chart. In this context, they analyzed the effects of the FOMC statement release and press conference on Bitcoin volatility.

|

| 60 minutes of volatility: BTC during the FOMC |

Active day traders are the most affected by the FOMC-driven volatility in Bitcoin price. Therefore, rate hike expectations for September 21 guarantee extremely high volatility. A 100 bps rate hike is likely to have a negative short-term impact on BTC price. However, according to experts, a softer 75 bps hike is likely to have a positive impact.

In longer time frames, intraday volatility is irrelevant. But the Federal Reserve's medium-term outlook and the hiking cycle play an important role in determining the direction of Bitcoin's trend reversal. BigCheds, a crypto analyst and trader, assessed the BTC price trend in this context. The analyst noted that BTC should remain above $18,923. According to the analyst, a drop below this price level would mean a downtrend reversal in BTC price.

|

| BTC price chart |

Follow us on Twitter, Facebook, and Instagram to be instantly informed about the latest news.

Post a Comment