3 Analysts: We Expect a Drop in These Altcoins on Binance!

Crypto analyst Tony M says that while the Merge talks and speculation continue, the leading altcoin Ethereum (ETH) may show stagnant price action. Increasing buying interest cannot hold Ripple (XRP) as it drops to $0.31, according to analyst John Isige. Another analyst, Filip L, notes that Crypto.com (CRO) price has broken and a drop below $0.10 is possible. We have compiled analysts' analysis of ETH, XRP and CRO for our readers.

“The Ethereum price of the leading altcoin appears to be tied to the triangle”

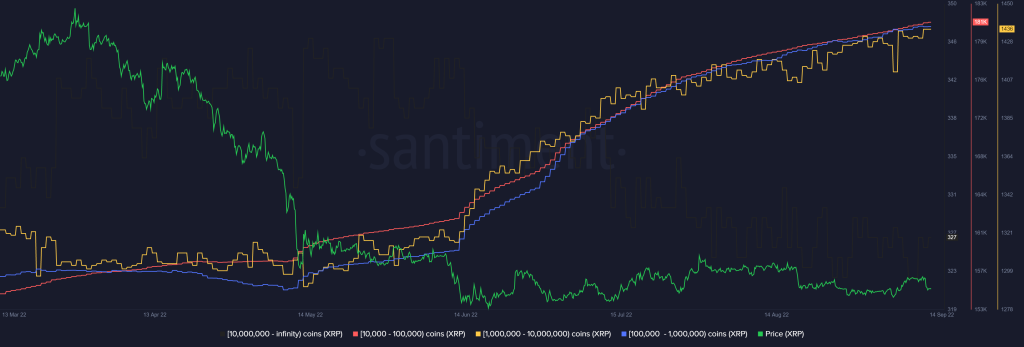

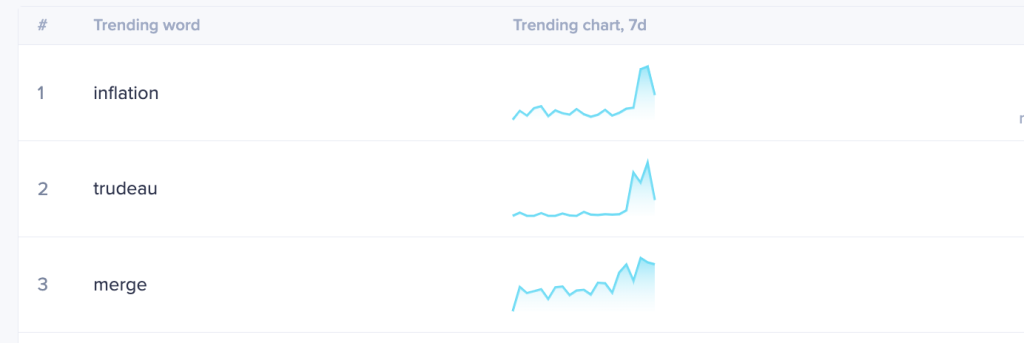

The upcoming Merge event is provoking substantial speculation about where the price is headed. That's why Ethereum price is on everyone's mind. According to Santiment 's Social Media Indicators, Ethereum Merge is currently ranked third in popular discussions across all social media platforms, as you've been following on cryptoify.blogspot.com. There are rumors and speculations that Ethereum's big day will bring a big move. Despite this, the techniques show that nothing spectacular will happen.

The leading altcoin lost 13% of its market cap after the US CPI report. It is currently up for auction for $1,595. On larger timeframes, the sell is relatively less in terms of the volume and size of the candlestick. Additionally, the Relative Strength Index hints that a big sell-off may not be the next move. Thus, he stepped back into the supporting zone.

|

| ETH daily chart |

A triangle consolidation is likely forming based on shrinking volume and RSI reading. If this is true, it is possible that the altcoin price is witnessing ordinary range-based price fluctuations as Merge approaches. However, a break of the $1,419 swing low would invalidate the triangle idea. This is also likely to trigger a capitulation event towards $1,270.

“XRP pulls back to $0.31 before trend reversal”

Ripple price has lost up to 8% in the last 48 hours. Against this, it exhibits a weak recovery movement. The token started to give up on gains after encountering intense resistance around $0.3600. XRP is rocking at $0.3300 at the time of writing. The bulls are dealing aggressively with the $0.3400 resistance, reinforced by the 50-day (yellow) Simple Moving Average (SMA). The rejected token at $0.3600 has lost up to 8% of its value. However, it slowed down the downtrend at $0.3306.

A bearish signal from the Directional Movement Index (DMI) is likely to fail the pressure for a sudden trend reversal. Rates supported the continuation of the downtrend as the index's –DI rose above +DI. Traders looking forward to dropping XRP need to closely watch the gap between these two signal lines to confirm the increasing overall pressure.

|

| XRP daily chart |

As XRP drops, it is expected to continue to gather liquidity. According to Santiment's Supply Distribution metric, XRP holders have not stopped their quest to fill their bags since May 2022. Addresses holding 10,000 to 100,000 tokens rose to 181,000, from about 158,000 registered on May 9. Subsequently, the address group holding between 1 million and 10 million tokens increased from 1,298 to 1,436 in the same period.

|

| XRP daily chart |

“As the river of cash dries up, the CRO price will drop”

|

| CRO daily chart |

At the same time, some retracement of Tuesday's losses is likely to be a normal market reaction. Certainly, there will always be some bargains and bulls willing to get the CRO at a discount after the drop. As the bulls attempt to restart last week's rally, gains of up to $0.1200 are possible across the board.

Source: Fxstreet

Follow us on Twitter, Facebook, and Instagram to be instantly informed about the latest news.

Post a Comment