Ethereum Merge Happened! What Has Changed and What are the Expectations?

Ethereum Merge is finally done after years of work. Ethereum Merge will have a huge impact on the crypto ecosystem. Despite its short history, crypto has a few notable updates such as Merge and ETHW hard fork. The successful completion of Merge is thought to affect the future of the crypto market.

What is Ethereum Merge and why is it important?

Merge is the planned multi-year transition of Ethereum , as we have also reported as cryptoify.blogspot.com. Ethereum's goal is to move from proof-of-work (PoW) to proof-of-stake (PoS) and reduce the carbon footprint of Blockchain by 99.95 percent. The launch of the beacon chain in 2020 was the first step in this transition. Completion of the last shadow fork was the preliminary finale.

Miners and PoS proponents have announced a hard fork to keep the blockchain alive and for those who don't want to switch to the PoS chain. Therefore, with the launch of the PoS chain, it is likely that the PoW chain will exist and continue to operate in parallel. However, Vitalik Buterin stated that he does not think this new hard fork will work. Merge represents the end of an era for Ethereum. All the efforts of the developers and team are focused on scalability and reducing transaction costs after migration.

The main Ethereum Blockchain, its resources, key partners and institutions will likely adopt the PoS version, further increasing the adoption of ETH . Ethereum's migration journey begins with Merge. The move to proof-of-stake marks a halfway point in Ethereum's journey. Developers next main goal is sharding. Sharding aims to improve scalability by dividing the Ethereum Blockchain into parallel segments.

Ethereum Merge: Risks and challenges

Industry experts, crypto advocates and influencers have evaluated the potential risks and challenges associated with Ethereum Merge . You can find these items below:

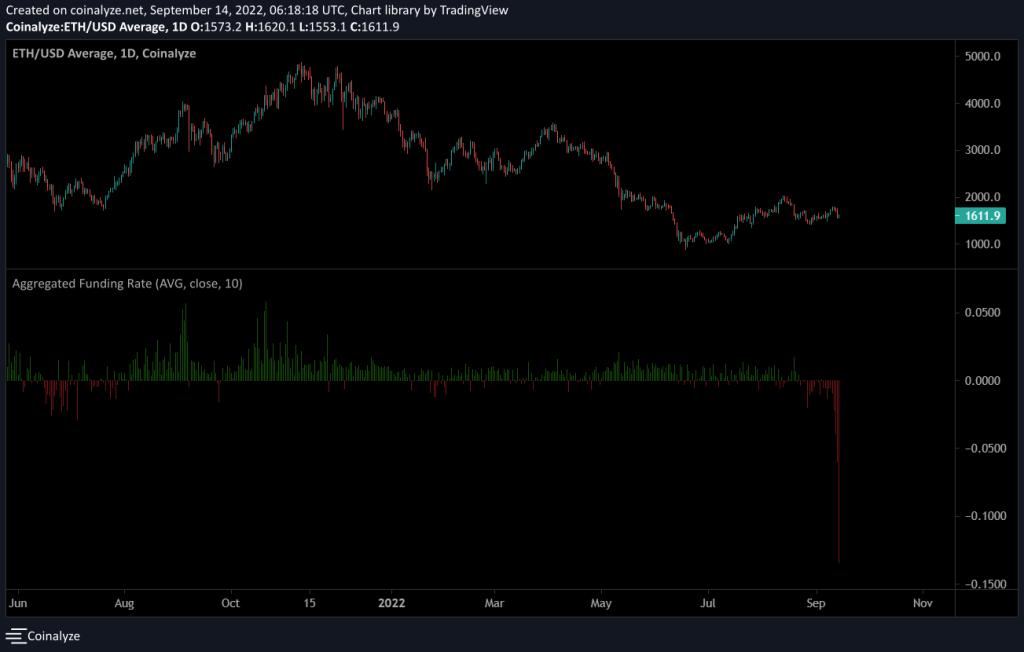

- Merge could trigger negative funding: There is growing concern among investors about negative funding. In the spot markets, Ethereum traders will receive ETHPoW tokens. These tokens will be airdropped at no additional cost. It will be sold in open markets. It is said that as a result of these trading strategies, excessive open positions in perpetual and forward contracts will cause negative funding. Negative funding means traders are in a downtrend. The average funding rate on major exchanges has dropped to its most negative level ever. Holding an open position in Ethereum is more expensive than ever before in history.

- Minor bugs can occur: With the current difficulty, the hash rate, and the pressure on the successful completion of the merge, there is a possibility that there will be some minor glitches that may arise along the way. Proof-of-stake validators will take on the responsibility that miners have assumed since the launch of Ethereum . Therefore, glitches are likely to occur.

Trading strategies for Ethereum after Merge

$22 billion bet on ETH2, good or bad?

CME group launches Ether options in response to Merge

Where is Ethereum price headed after Merge?

What is the latest situation in the price after the merge?

Follow us on Twitter, Facebook, and Instagram to be instantly informed about the latest news.

Post a Comment