FED and ECB Statements! Cryptocurrencies Will Affect Directly!

The Fed and the President of the European Central Bank took the microphone at the same time. The statements made were quite harsh and cryptocurrencies do not expect good days (medium term).

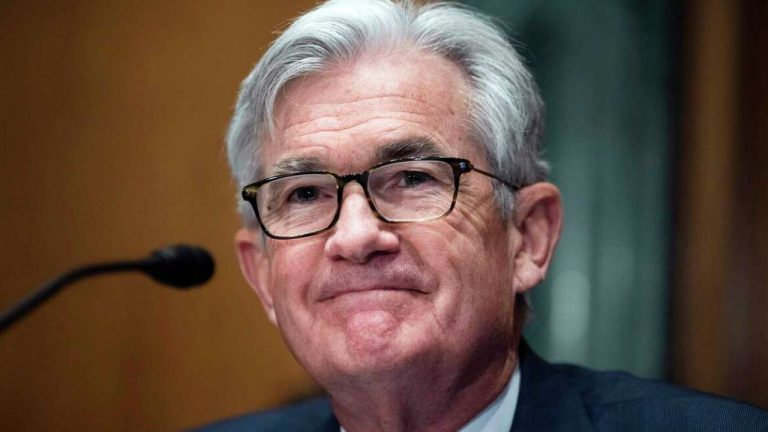

Fed Chairman Powell and ECB Chairman Christine Lagarde made many statements that will directly and indirectly affect cryptocurrencies. Powell also touched on the issue of stablecoins. Today, especially the last 2 hours have been extremely active for crypto money investors. With the effect of the statements, the US stock markets opened negative and Bitcoin does not seem to have priced in the rhetoric yet. So what happened?

FED Chairman Speaks

President Powell mentioned that the pandemic had far more dire consequences and attributed the inflation, which continues to rise today, to the pandemic. He also underlined that their determined stance will not change until inflation is restrained. Powell said exactly:

We will continue to act strongly until we end inflation. Our monetary policies will not be affected by political considerations. If there had been no pandemic , we would not have had to deal with such high inflation today. We are still far from reaching our 2% target. In the past, the damage of early monetary expansion has been very great, we will not experience it again.

With his statement, the Fed chairman also shattered the dreams of investors who were expecting relief in the markets before the US elections. Many investors predicted that the Fed would calm down before the upcoming elections and cryptocurrencies would recover along with stocks. This door has been severely closed by the Fed. Moreover, after the extremely hawkish statements, the probability of a 75bps rate hike (for the September 21 FOMC Meeting) rose above 80%.

Talking about stablecoins , Powell thinks they can find a place in the financial system. But Powell did not hesitate to say that they should be arranged appropriately.

Historic Step from the European Central Bank

The ECB (European Central Bank) hiked interest rates by 75bps for the first time. The EURO, which fell below 1 dollar, was already on the agenda for weeks. The ECB, which has taken heavy steps at the point of tightening policies, is now stepping on the gas. While the Fed has been increasing interest rates for a long time, the fact that the ECB has increased interest rates at a very high rate of 75bps for the first time, despite the intense stubbornness of the ECB, which shows that the economy on a global scale is not going to a good point. The real bear season for cryptocurrencies may not even have started yet.

Legarde mentioned that interest rates may rise further in the next meetings. Again, Powell made a similar statement and pointed to a rate hike in the next 2 meetings. While inflation and interest rates continue to rise all over the world, the only development that can lift cryptocurrencies is their exit from this spiral. It is possible that we will see continuous decreases for the next 1.5 years unless Bitcoin turns into an inflation protection tool for large companies with its scarce supply.

Follow us on Twitter, Facebook, and Instagram to be instantly informed about the latest news.

Post a Comment